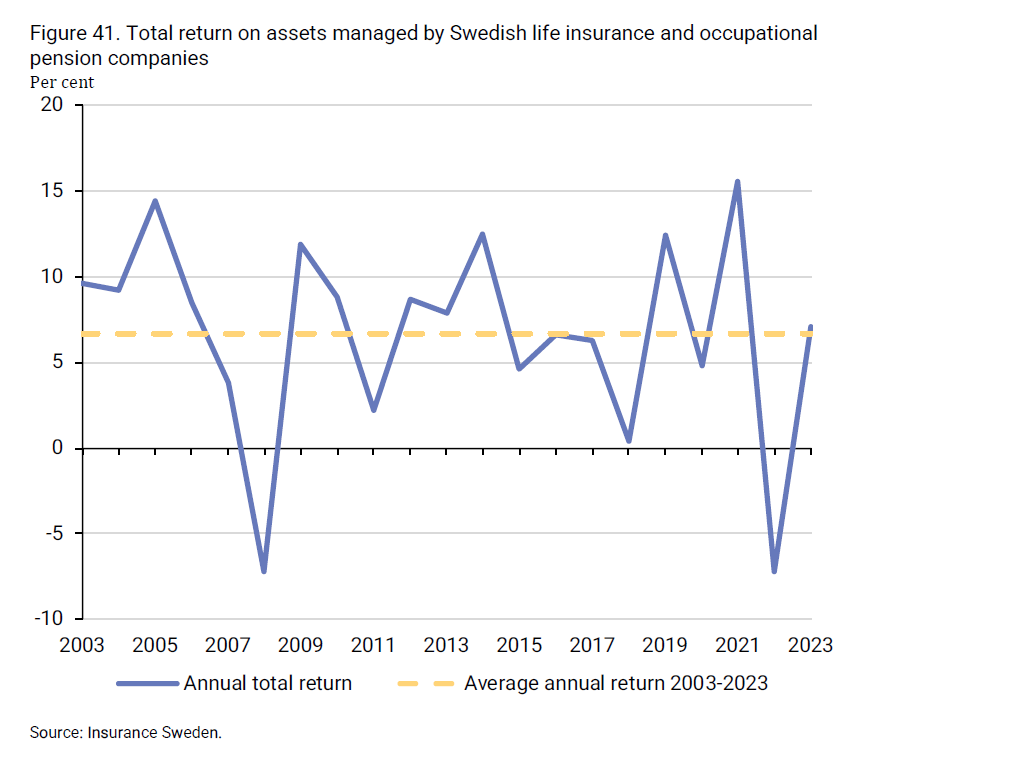

The return on assets held by life insurance and occupational pension compa-nies is significant as it affects the level of future pension payments.

In 2023, the return on assets managed by Swedish life insurance and occupa-tional pension companies was 7.1 per cent. This is slightly higher than the average annual return of 6.7 per cent over the past twenty years. The favour-able return in 2023 was primarily due to the positive developments in the stock markets in Sweden and globally, and the fact that a relatively large por-tion of the companies' assets are invested in equities. However, the return in a single year is of less importance as savings are long-term. Instead, it is the return over time that determines the level of future pension payments.