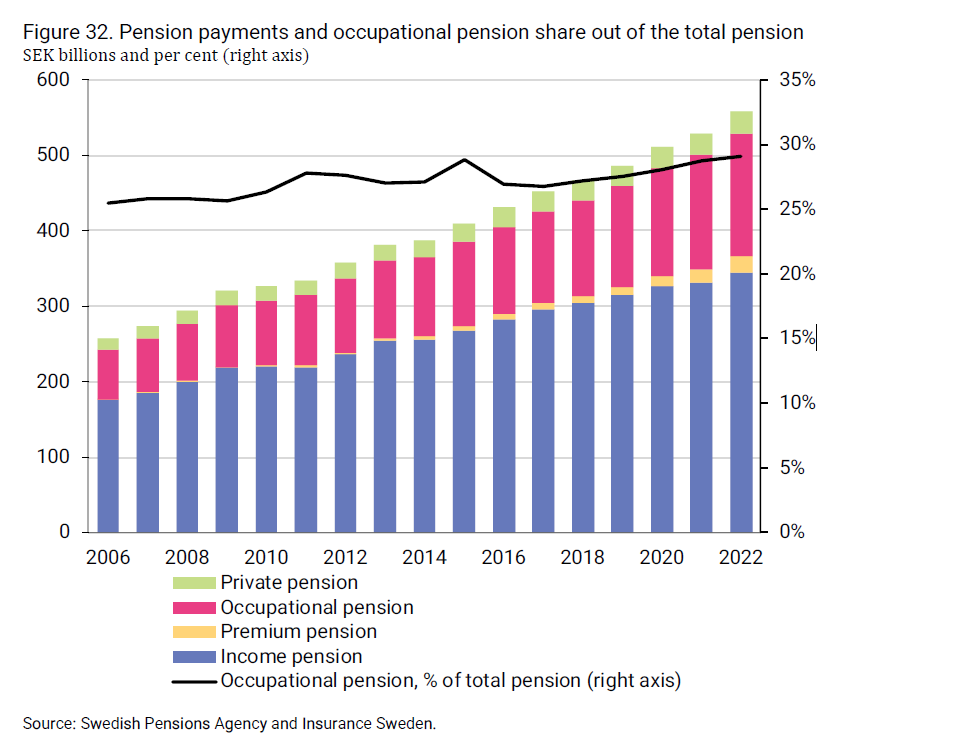

The total pension payouts in 2022 amounted to 558 billion SEK, a duplica-tion compared to 2006. In 2022, payouts from the national public pension by the Swedish Pensions Agency increased by 108 per cent, and payouts from life insurance and occupational pension companies increased by 135 per cent.

The Swedish Pensions Agency paid out just over 367 billion SEK in in-come and premium pensions to individuals aged 55 and older in 2022. Pay-outs from occupational pension insurance and private pension insurance amounted to 191 billion SEK. Occupational pension has become increasingly important for many individuals over time. Since 2006, the share of occupa-tional pension of the total pension has increased from 25 to 29 per cent and it is expected to continue to rise as savings in occupational pensions have in-creased significantly during the last decade.

The prerequisite for an occupational pension to be paid to an individual is that contributions (“savings”) have been made to the occupational pension during working life. The most common practice is for the employer to pay premiums to a life insurance or occupational pension company that manages the capital until it is time for payment. An individual who has had several dif-ferent employers during their working life may have several different occu-pational pension insurances. An employer can also finance and secure their occupational pension commitment internally by recording the pension obli-gations in the company's balance sheet or making contributions to a pension foundation. Out of the total occupational pensions paid out in 2022, life in-surance and occupational pension companies accounted for about 75 per cent.