Both companies and individuals can save in endowment insurance. Endow-ment insurances serve more as a "wrapper" for various investment products, where the policyholder can choose beneficiaries and structured payouts. En-dowment insurance is not specifically intended for pension savings as it is possible to deposit and withdraw the entire or parts of the capital during the savings period, and the capital is therefore not locked until retirement.

At the end of 2022, around 1.5 million individuals had endowment insur-ance, and the savings amounted to a total of just over 455 billion SEK. Indi-viduals accounted for slightly over half of the total savings percentual (54 per cent), while companies accounted for the remaining part. The average savings for individuals was 297,000 SEK per person.

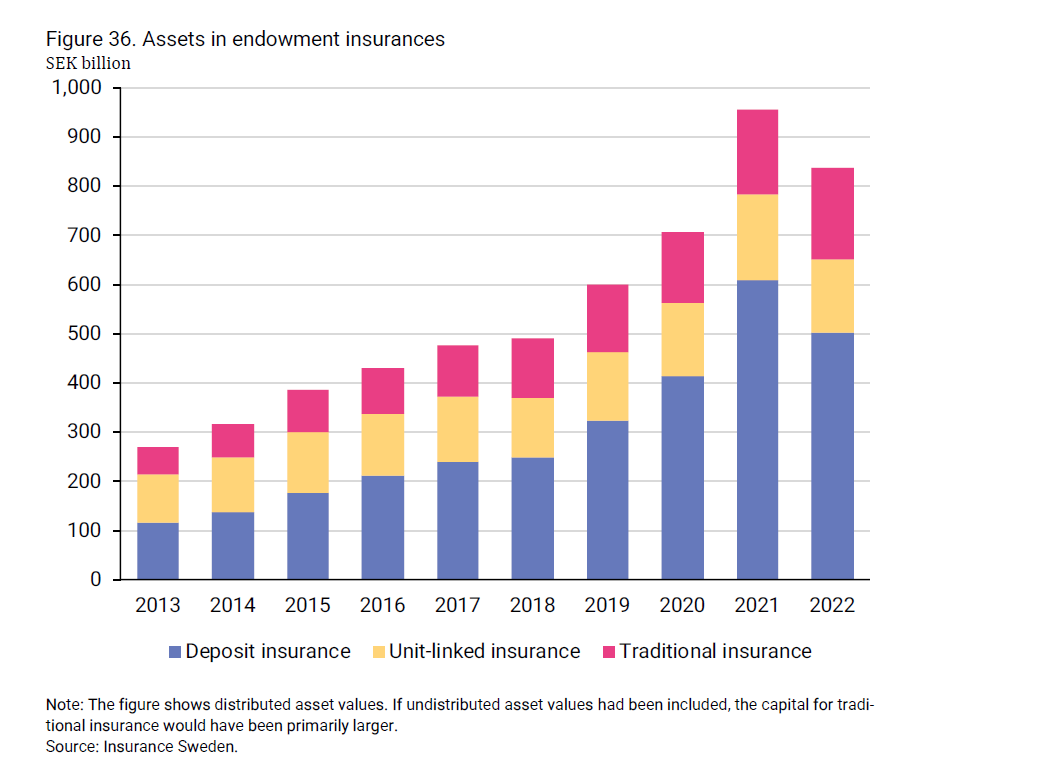

In 2022, the combined value of endowment insurances amounted to nearly 838 billion SEK, which can be compared to 2013 when it amounted to nearly 271 billion. In 2022, deposit insurance accounted for nearly 60 per cent of the value of endowment insurances. The remaining part is distributed al-most equally between unit-linked insurance (18 per cent) and traditional in-surance (22 per cent).