In Sweden, every motorized vehicle driven on the road must have motor third party liability insurance that covers personal and property damage in case of an accident. However, motor third party liability insurance does not cover damages to the driver's own vehicle.

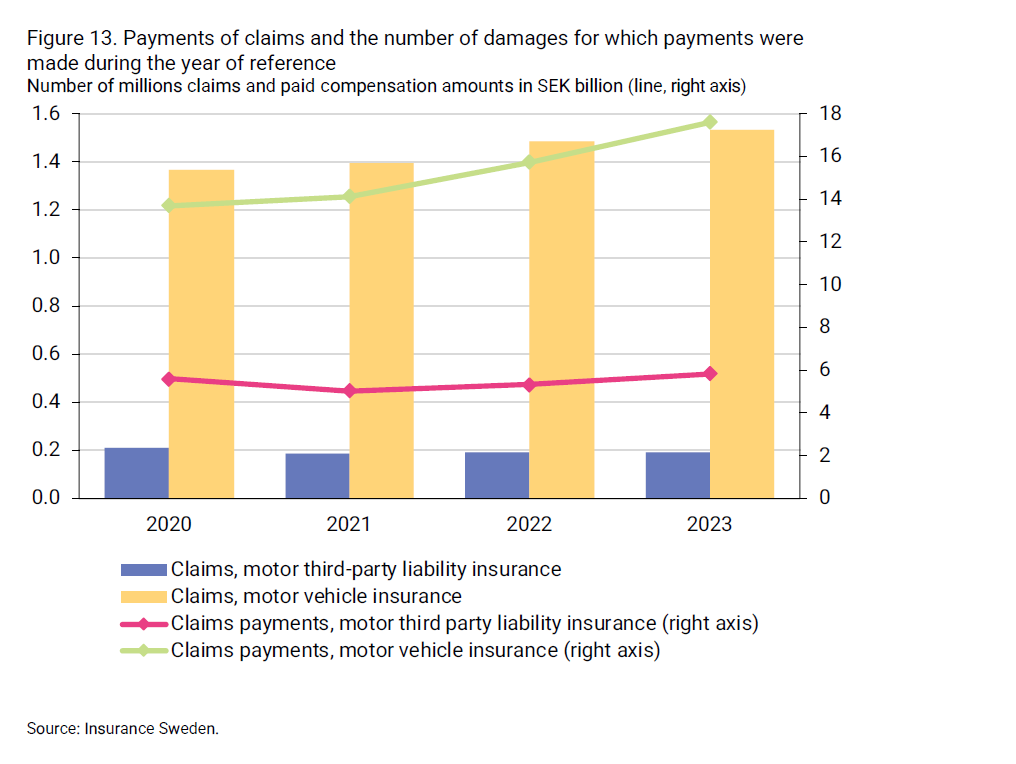

For that protection, a separate motor vehicle insurance is required. Such insurance policies can also cover more complex insurance aspects such as theft and damages to the vehicle it-self. In 2023, a total of just over 23 billion SEK was paid out in insurance compensations for damages covered by these insurances. The claim pay-ments were related to just over 1.7 million damages in total.

Since 2020, the payments for damages covered by motor vehicle insurances have increased by 29 per cent, while the payments for damages covered by motor third-party liability insurance have decreased by 4 per cent. At the same time, the number of damages for which payments were made during the year of reference has increased by 12 per cent for motor vehicle insur-ances and decreased by 10 per cent for motor third-party liability insurance.

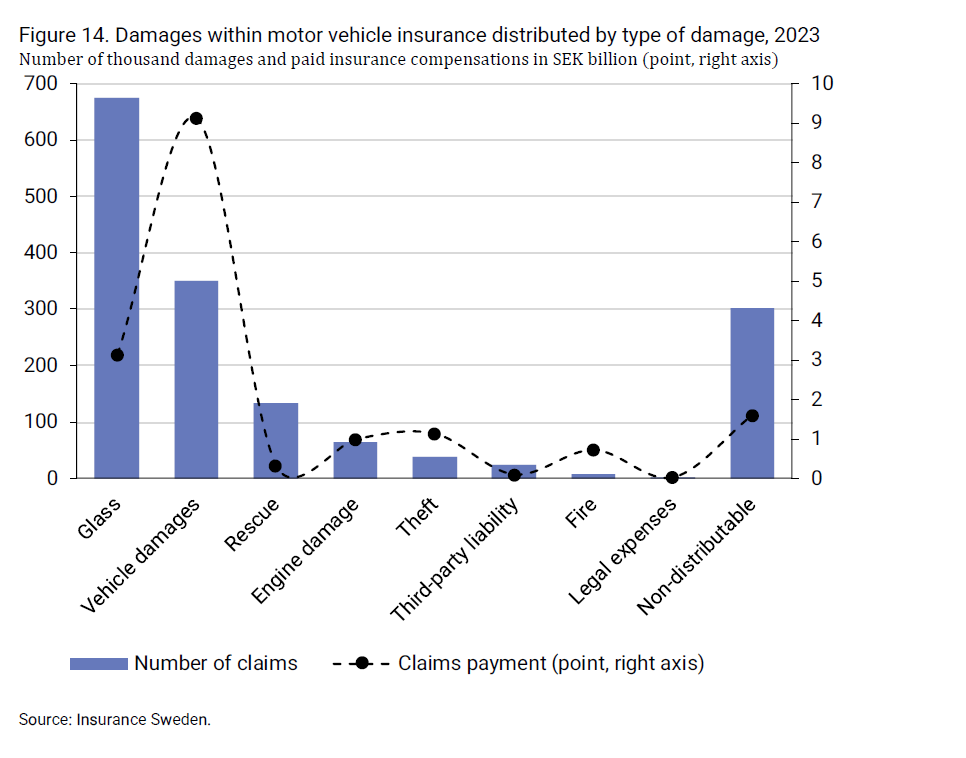

Glass damage, such as damage to windshields on a motor vehicle, was the most common type of damage for which insurance companies paid compen-sation in 2023. Payments for glass damage amounted to 3.1 billion SEK. However, the highest total compensation was paid for motor vehicle dam-ages (i.e. damage to the vehicle), where the payments amounted to 9.1 bil-lion SEK.