Insurance compensations is paid out for damages that can occur, such as car accidents, water leaks in the home, or theft incidents. Compensations may also be paid out if a person experiences illness or an accident that affects their ability to work and earn income.

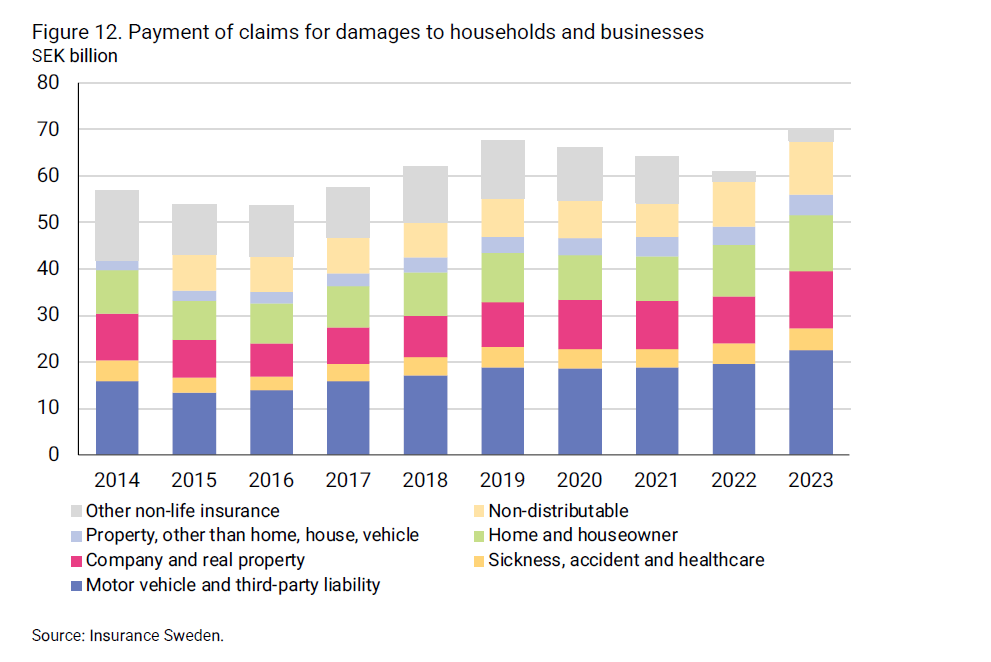

In 2023, 3.4 million damages were re-ported to non-life insurance companies, which is an increase of 11 per cent. During the same period, paid compensations increased by 15 per cent. In total, close to 70 billion SEK was paid out in compensation for damages in 2023. More than half (56 per cent) of the compensations were for damages that occurred in 2023, while the remainder was for damages that occurred in previous years. The reason for the delay in payments is that certain types of damages, such as fire and traffic damages, can take a long time to investigate. Another explanation is that claims for damages sometimes arise sometime after the actual occurrence of the damage. Compensation for damages can also be paid out as annuities over a long period of time for individuals who have suffered a loss of work capacity due to, for example, a traffic accident or work-related injury. Annuities compensate for future income losses.

The largest portion of the payments in 2023 was for damages related to motor vehicle and third-party liability insurance. These damages accounted for nearly one-third (32 per cent). This was followed by damages related to home and houseowner insurance (17 per cent) and damages within business and real property insurance (17 per cent). Damages within sickness, acci-dent, and healthcare insurance accounted for seven per cent, while damages within other property insurance (such as boat, animal, and product insur-ance) accounted for six per cent. A total of 12 billion SEK was paid out to companies, while the remaining compensation of 58 billion SEK was paid out to households and individuals.