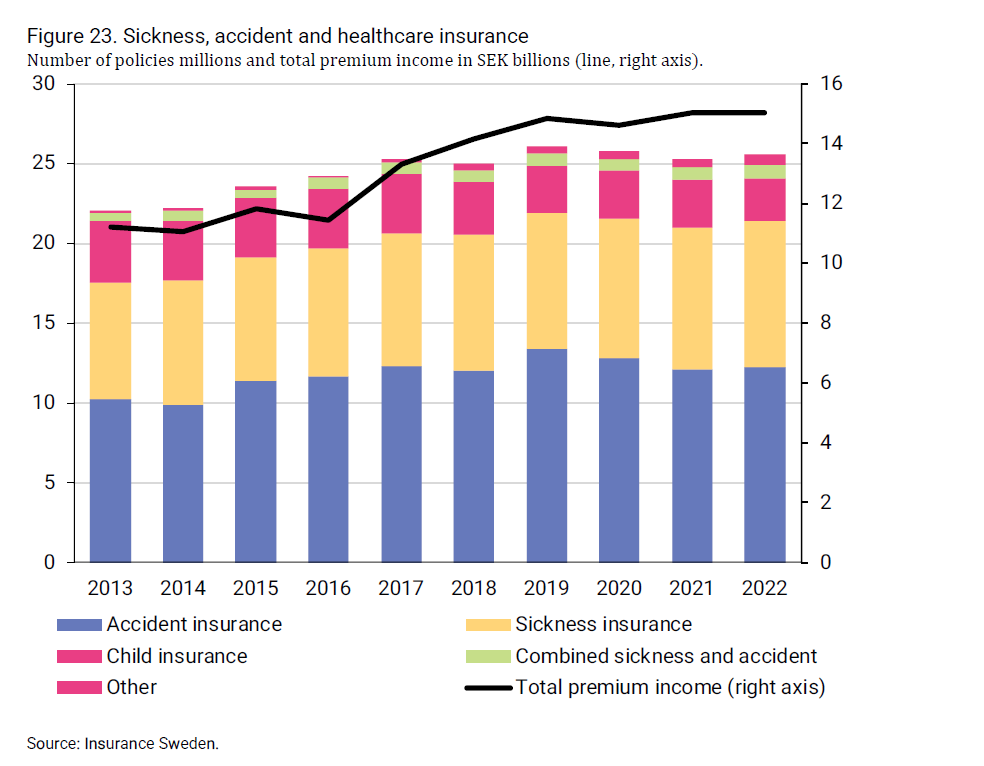

At the end of 2022, there were nearly 26 million sickness, accident, and healthcare insurance policies in Sweden.

Policyholders paid over 15 billion SEK in premiums for these insurances. The reason for the large number of policies is that an individual can have several different policies. Just under half (48 per cent) were accident insurance policies, and just over one-third (36 per cent) were some kind of accident insurance. There are also com-bined sickness and accident insurance policies, such as child insurance. The latter accounted for approximately eleven per cent of all sickness and acci-dent insurance policies at the end of 2022. About three per cent were com-bined sickness and accident insurance policies for adults.

Over 43 per cent of the sickness, accident, and healthcare insurance policies in place at the end of 2022 were not paid by the individuals themselves but by their employers. Around 39 per cent of the policies were group insurance policies, where a representative – such as an employer or a trade union – has negotiated a scheme that allows individuals, through their employment or membership, to sign up to the insurance, often at a favourable price. The re-maining sickness and accident insurance policies were individual policies, purchased by the individuals themselves.

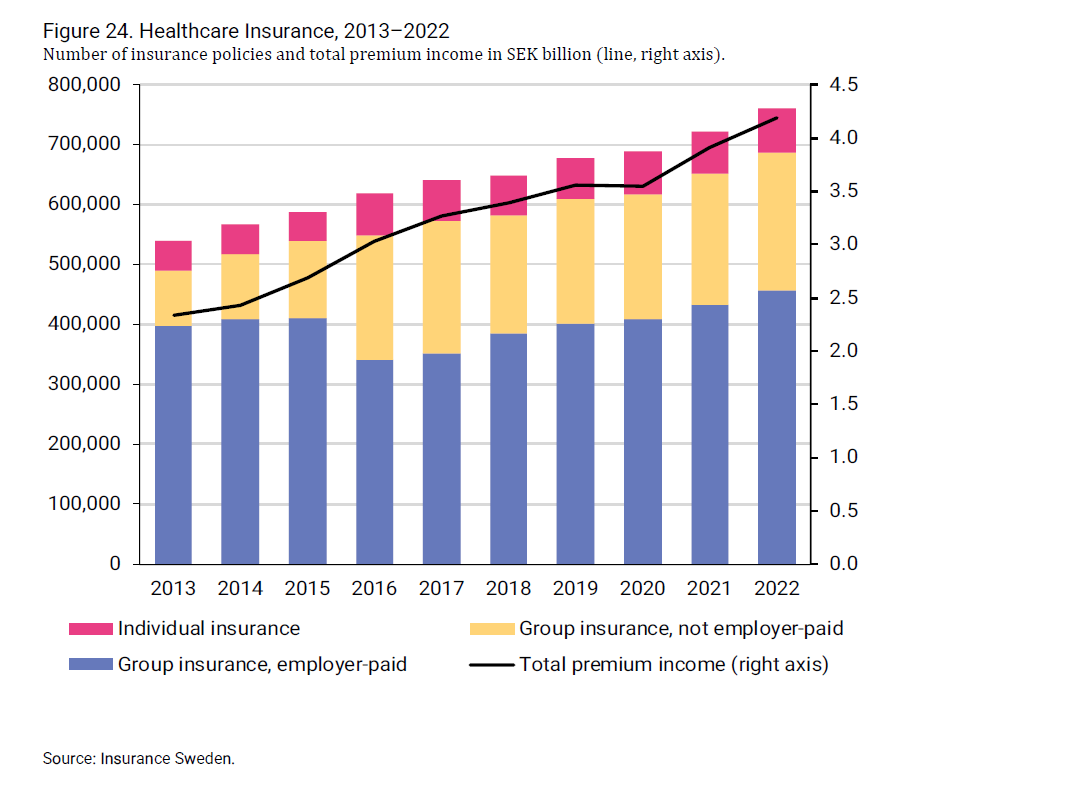

The healthcare insurance is an insurance policy that typically covers both healthcare and rehabilitation services. Both life insurance companies and non-life insurance companies offer healthcare insurance. Life insurance com-panies account for just under one-third of the number of policies, while non-life insurance companies account for the remaining two-thirds.

The number of healthcare insurance policies has been increasing steadily over a long period of time. By the end of 2022, more than 761,000 individu-als had a healthcare insurance policy. This represents an increase of 41 per cent since 2013. Nearly 6 out of 10 policyholders have their insurance through their employment and the premium is paid by their employer. Slightly over 3 out of 10 have signed up for their healthcare insurance as a group policy, for example, through their trade union. The remaining, approx-imately ten percent, have an individual healthcare insurance policy that they have personally signed up for.

In 2022, policyholders paid around 4.2 billion SEK in premiums for healthcare insurance. The healthcare services provided under the healthcare insurance are financed only by the premiums paid by the policyholders.

The content of a healthcare insurance policy may vary slightly between dif-ferent insurance companies but it generally includes healthcare advice, care planning, and specialist care. It often includes preventive measures and re-habilitation efforts as well. The policy may also cover costs for medication and post-treatment care. Services that are not covered or managed within the healthcare insurance policy include emergency care, intensive care (ICU), childbirth, cosmetic treatments, and end-of-life care (palliative care).

The healthcare provided within a healthcare insurance policy primarily fo-cuses on planned specialist care. The most common services covered by the policy include visits to physiotherapists and/or naprapaths, as well as visits to psychologists. Therefore, these interventions are separately reported within specialist care. Other common services within specialist care include visits to dermatologists, ear, nose, and throat specialists, gynaecologists/ urologists, and more.

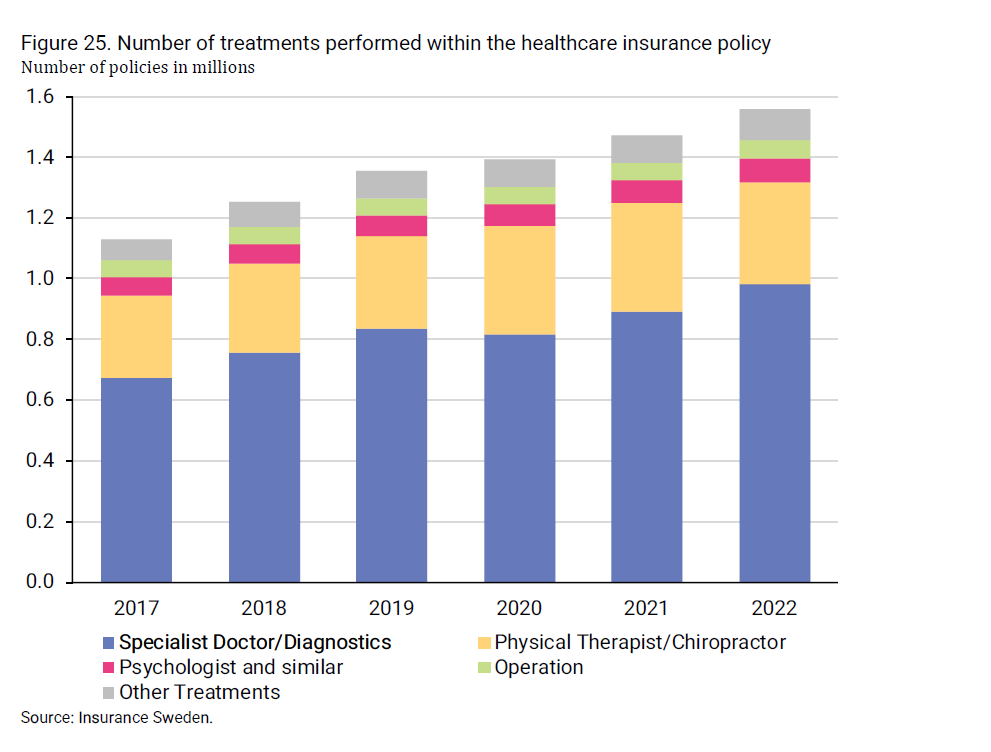

In 2022, approximately 1.6 million treatments were carried out under the healthcare insurance policy. Many of these treatments were related to visits to specialist doctors for diagnostic purposes.

All services within the healthcare insurance policy are preceded by a medical assessment, like the process within publicly funded healthcare. Treatment is only carried out if there is a determined need for it, and it is performed ex-clusively by private healthcare providers in Sweden or abroad.