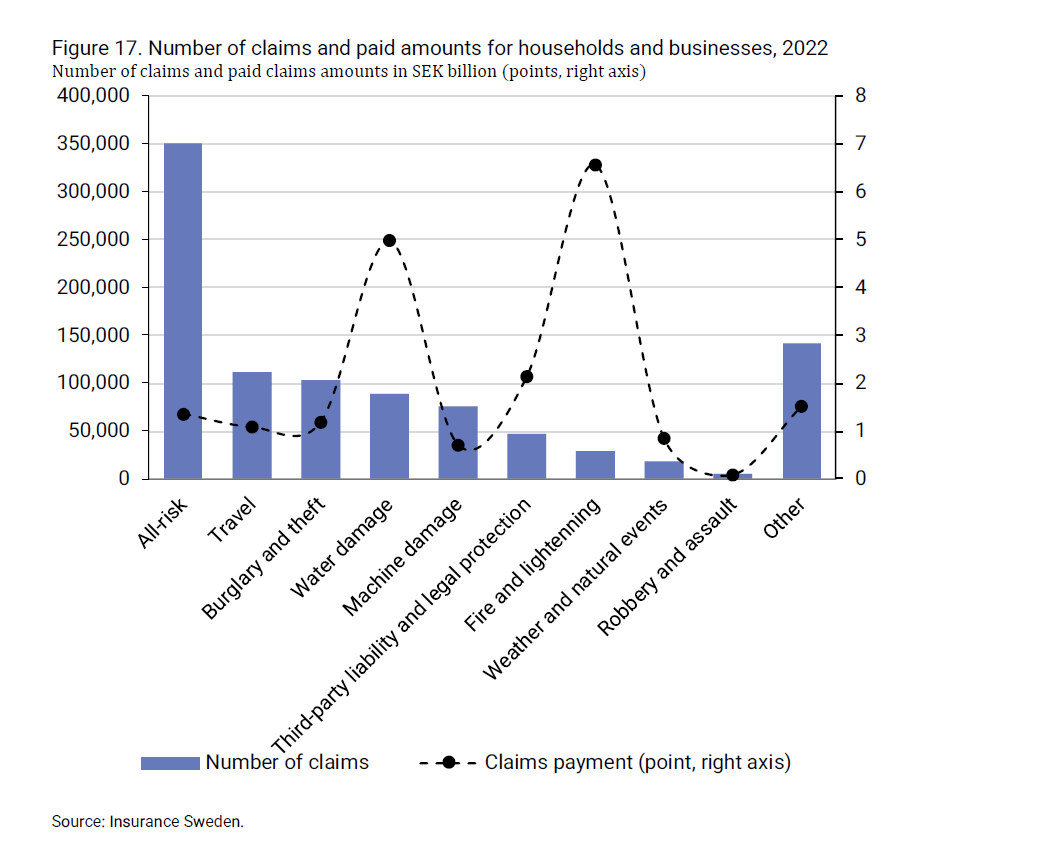

One of the most common reasons for households and companies to receive insurance payments is for a so-called all-risk claim, which is covered by an all-risk insurance policy.

Such insurance, often included in home insurance, applies when the policyholder experiences a sudden and unforeseen acci-dent. This can include events such as the insured dropping their camera while traveling or forgetting their wallet on the bus. In 2022, there were over 351,000 all-risk claims. For these claims, insurance companies paid out a to-tal of nearly 1.4 billion SEK.

However, the highest-value claims were those caused by fire and lightning, followed by water damage. The total amount paid out for fire and lightning damage was 6.6 billion SEK, and for water damage 5 billion SEK in 2022.