Most people living in Sweden have home insurance, but not quite everyone. Home insurance is a package of various insurances that can provide compensation to the policyholder in cases such as burglary, theft, and fire. The insurance covers items owned, rented, or borrowed by the policyholder for their private use, such as furniture, clothing, household items, appliances, and electronics. It can also provide compensation for damages that may occur during travels, incidents of assault, claims for damages, or the need for legal protection.

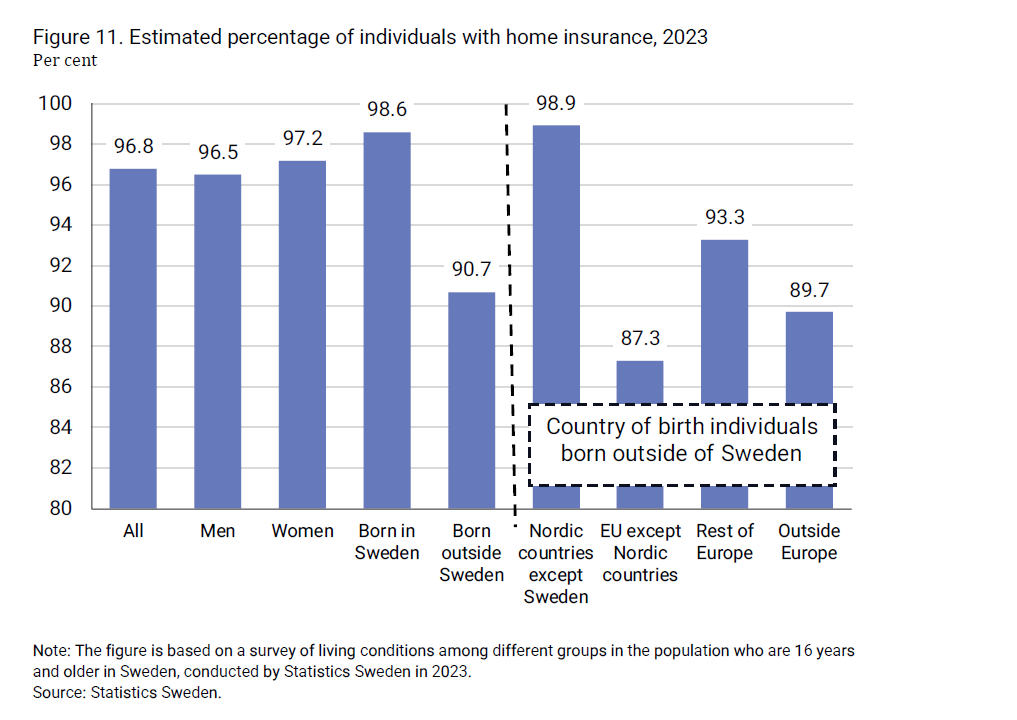

Currently, it is estimated that approximately 97 per cent of the population in Sweden has home insurance. Thus, just over three per cent, around 400,000 individuals, lack home insurance, which means they are without, among other things, legal protection, and financial security both at home and while traveling. It is more common for men than for women to lack home insur-ance, as well as for foreign-born individuals, especially those born outside of Europe.